Hari Iyer | SyncEzy

CEO3 Min Read

Mar 26, 2024

Remember the days when we had to submit TFN declarations with pen and paper, Thankfully, Australian taxation office has submitted clear directions for software developers and companies on how to do this digitally.

For a detailed view, please click the button below.

For to understand the summary, keep on reading, We have also provided some screenshots and clear directions on how to do this in HiBob or in Zoho People

### Key Changes in TFN Declarations

With the digitalization of the TFN declaration process, employers need to incorporate specific functionalities within their Human Resources Information Systems (HRIS), like Hi Bob. The process involves creating a digital form where employees can declare that the information they provide is true and correct by selecting an option, typically marked as “True.”

### Implementation in HRIS

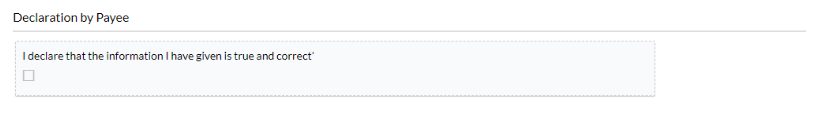

To comply with ATO guidelines, the HRIS must include a field titled “Declaration by Payee,” where employees affirm the truthfulness of their information. Additionally, the system should authenticate the identity of the employee through secure methods such as passwords or single sign-on features. Recording the date and time when the declaration is made is also essential, serving as part of the audit trail.

### Security and Compliance

The ATO specifies requirements for electronic signatures on TFN declarations to ensure that the identity of the employee is verified securely. This includes using passwords or other secure authentication methods that are unique to the employee. Moreover, the system should maintain a log of when the declaration is filled out, which is critical for compliance and security purposes.

### Benefits of the Digital Approach

Switching to digital TFN declarations offers several advantages, including reducing paperwork, streamlining tax-related processes, and enhancing the security of personal and financial information. It also aligns with the ATO’s guidelines for electronic submissions, facilitating improved compliance with tax laws.

### Conclusion

The adoption of digital TFN declarations represents a shift towards more efficient and secure handling of tax-related documents by Australian employers. By integrating these digital processes into HRIS like Hi Bob, employers can ensure compliance with ATO requirements while also benefiting from streamlined administrative procedures. This update to the TFN declaration process reflects the broader trend towards digitalization in workplace administration.

How to do this in HiBOB

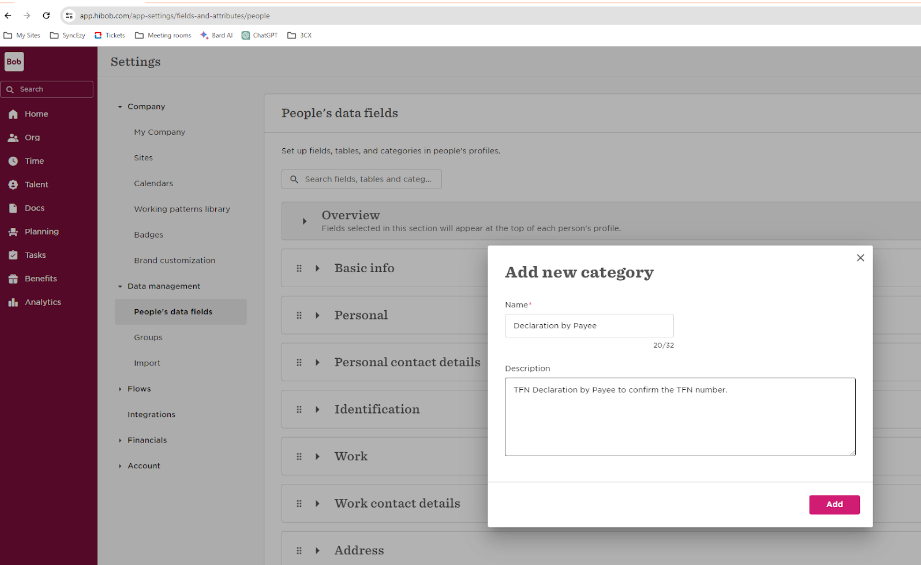

Add a new Category or Section called : Declaration by Payee

You can create a new section or add this as a question Just after the Personal Identity section in the onboarding process.

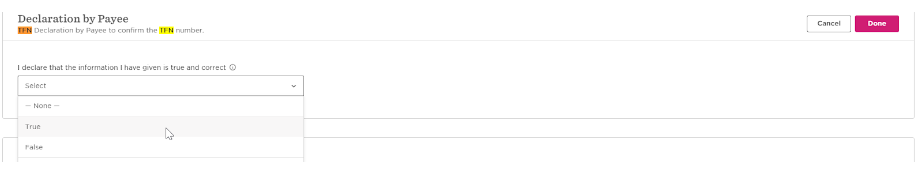

This will appear as below when the employee fills out the form and will meet all the ATO requirements for Digital TFN declaration.

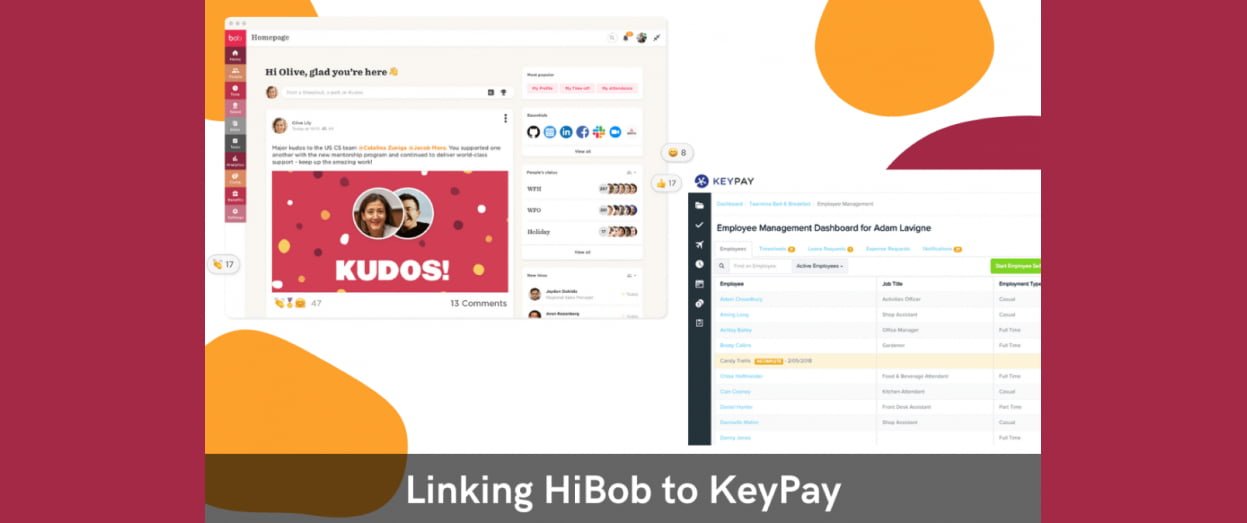

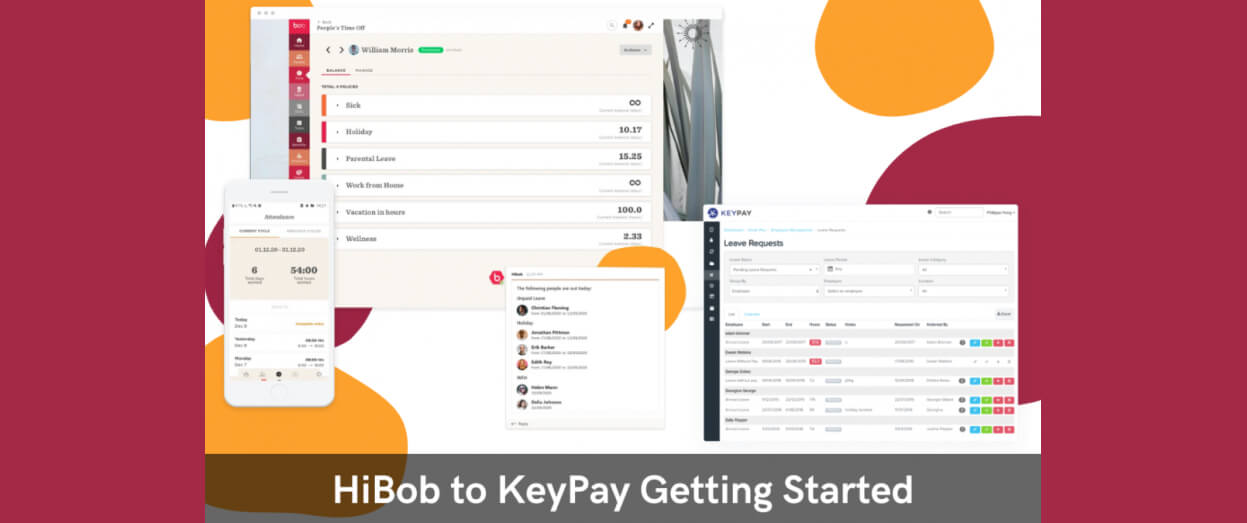

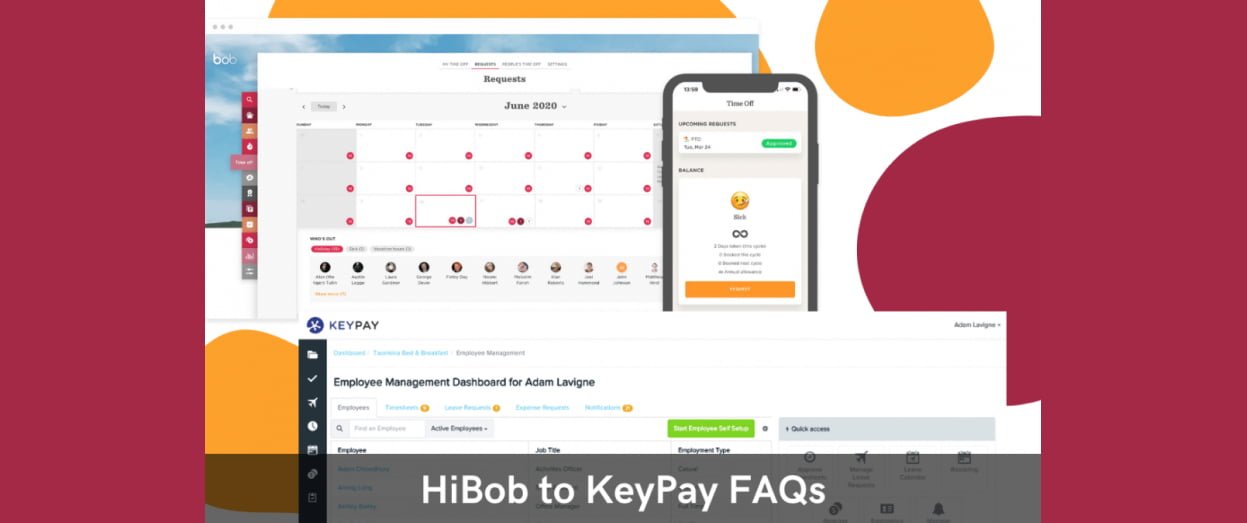

If you are using our HiBob to Keypay integration, we will then automatically sync this TFN declaration to Keypay / Employment Hero so you can seamlessly do payroll.

Doing the digital TFN declaration in ZOHO People.

Edit the Employee form

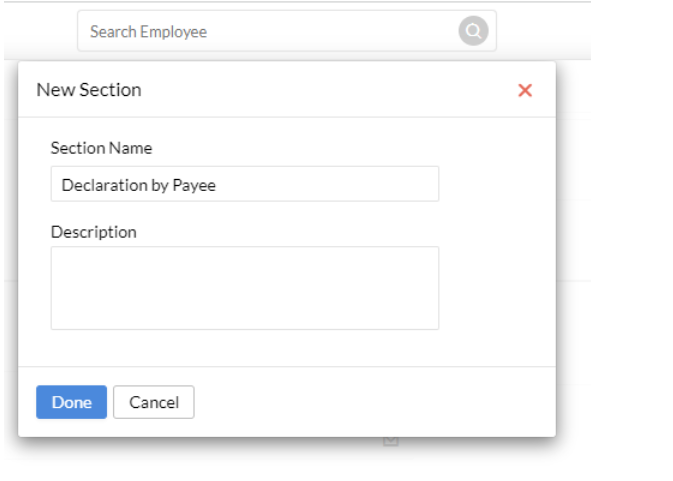

Create a new section called “Declaration by Payee

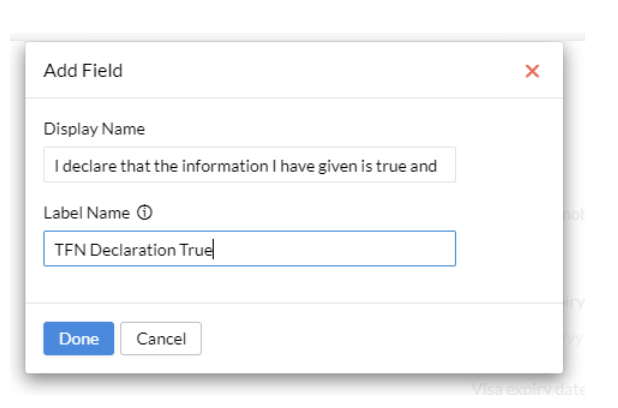

In this section add a new Checkbox field

I declare that the information I have given is true and correct’

It will end up looking like this at the bottom of the form.